We all love new things—from the latest piece of technology to the newest TV series.

It’s human nature to seek out new and unique experiences, and food is no different.

Consumers like to keep an eye out for the newest ingredients and techniques in trendy street food cuisines, limited-edition fast-food items and products on the supermarket shelves.

But how do trends develop? How does the industry map trends? And how do culinary companies know which flavours will most appeal to different consumer groups and applications?

With fantastic food and beverage customers spanning the industry and world, Kalsec is in a unique position to detect changes in food consumption and presentation. These industry insights, along with our deep expertise in mapping and predicting trends, allow us to help our customers develop new products sure to succeed. Read on to find out how our team defines, maps and tracks trends.

What is a Food and Beverage trend?

Food and beverage trends include any new ingredient, dish, cuisine, or culinary concept that is up-and-coming in the market.

Our team maps trends over four lifecycle stages:

1. Emerging

This is when the trend first appears, often on social media. There is still low awareness of it in foodservice, and it is nonexistent in retail and grocery sectors.

2. Developing

At this stage, a new buzz surrounds the trend. Social media and news outlets are reporting on the trend, and there is increasing prevalence in independent and high-end restaurants, as well as street food.

3. Establishing

Once a trend is established, it is seen in limited-time offers in mainstream restaurants and fast food, featured in new supermarket launches, and captured in mainstream media and food magazines.

4. Maturing

The last stage is when the trend is available in most foodservice and retail outlets. It becomes less prevalent on social media and mainstream news and is familiar to most people as a known flavour, dish or cuisine.

Matching Trends to Consumers

Once our team maps the stage of a trend’s development, we identify the consumer group it will most appeal to. Different consumers have varying comfort levels with adopting new trends. Food producers and brands often vary the way they position new products, flavours and dishes depending on their target audience.

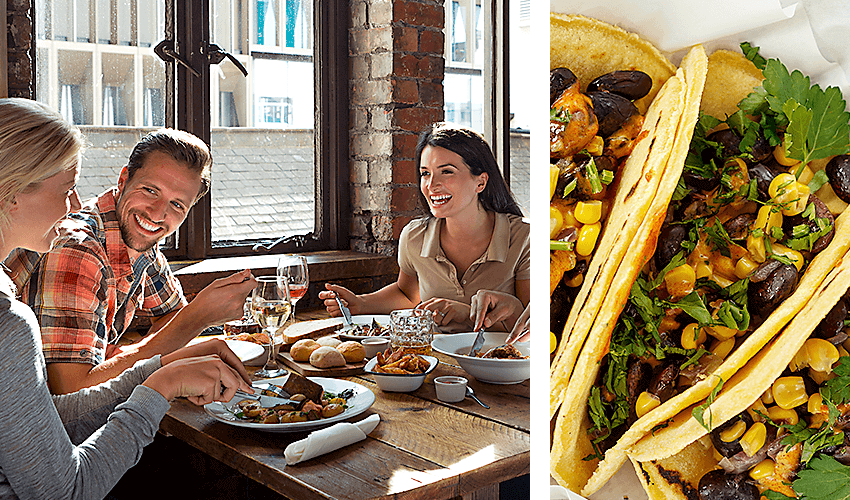

For example, Mexican dishes like fajitas and tacos are familiar to most consumers and widely available in all kinds of restaurants—from fine dining to fast food. As an established trend, these dishes appeal to less adventurous, risk adverse consumers who are hesitant to try new dishes until they are well established.

Alternatively, the herb epazote is traditionally used in Mexican cuisine but is not familiar to most consumers. This ingredient could be targeted at consumers who are adventurous, enjoy new experiences and like to be the first to explore new cuisines.

Not only can we map the right pairing of dishes and ingredients with the appropriate consumer groups, we can also map which applications are more suitable for flavour variation. Snacks, for example, are eaten in a number of ways, from a mini meal to an indulgent treat or a healthy energy boost. Their low price makes them the ideal application for trying a new flavour innovation. On the other hand, ready-meals—with their high price and thus greater risk for consumers—are ideal for known-and-loved flavours and more familiar trends, such as twists on classic cuisines.

Unique Strategies for Unique Flavours

Our team understands that predicting and capitalizing on trends requires more than a one-size-fits-all approach. Our Chefs and Marketers partner with food manufacturers to understand their application and consumer’s needs and determine the best culinary solution—whether it be a timeless green herb seasoning for a tomato sauce, or a provenance chili and punchy cardamom spice for a new snack launch.